Limited Liability Partnership

- Home

- Limited Liability Partnership

Limited Liability Partnership

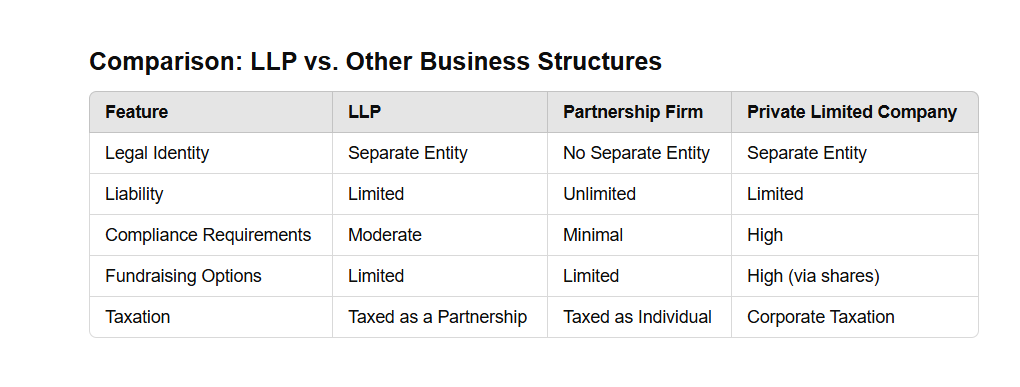

A Limited Liability Partnership (LLP) is a modern business structure that combines the benefits of a partnership with the advantages of limited liability. Introduced to offer flexibility in business operations, LLP is especially suitable for small and medium-sized enterprises, professionals, and startups. Unlike traditional partnerships, LLPs provide limited liability protection to their partners, meaning personal assets are safeguarded from the debts or liabilities of the business. Additionally, it operates as a separate legal entity, distinct from its partners.

What is a Limited Liability Partnership (LLP)

Key Features of an LLP

Separate Legal Entity:

- The LLP has its own legal identity, separate from its partners, allowing it to own property, enter into contracts, and sue or be sued.

Limited Liability:

- The liability of each partner is limited to their agreed contribution, protecting personal assets from business obligations.

Flexible Structure:

- Partners have the freedom to manage the business as outlined in the LLP agreement without strict corporate formalities.

Perpetual Succession:

- The LLP continues to exist irrespective of changes in partnership, such as the exit or death of a partner.

Minimum Compliance Requirements:

- LLPs have fewer compliance requirements compared to companies, making them cost-effective to manage.

Advantages of an LLP

Limited Liability Protection:

- Partners are not personally liable for the debts or actions of the LLP, offering a significant advantage over traditional partnerships.

Separate Legal Status:

- The LLP can own assets, enter into contracts, and operate independently of its partners.

Tax Benefits:

- LLPs often enjoy tax advantages, such as exemption from dividend distribution tax, compared to companies.

Operational Flexibility:

- The LLP agreement allows partners to define roles, responsibilities, and profit-sharing ratios as per mutual agreement.

Easy Formation and Management:

- Establishing an LLP is simpler than forming a company, and it has lower compliance costs.

Credibility:

- Registered LLPs inspire trust among clients, investors, and stakeholders due to their formal structure and transparency.

Challenges of an LLP

Limited Fundraising Options:

- LLPs cannot raise capital by issuing shares, which may limit growth opportunities.

Mandatory Compliance:

- Despite being simpler than companies, LLPs must file annual returns, maintain financial records, and comply with regulations.

Profit Distribution:

- Profits must be distributed as per the LLP agreement, which may not allow for reinvestment like in corporations.

Restricted Scope:

- Certain business activities, such as banking and insurance, are not permitted under an LLP structure.

How to Form an LLP?

The process of registering an LLP involves the following steps:

Choose a Name:

- Select a unique name for the LLP that complies with naming guidelines and isn’t similar to existing entities.

Obtain Digital Signatures:

- Digital signature certificates (DSC) are required for all designated partners to file electronic documents.

Apply for a Director Identification Number (DIN):

- Designated partners must obtain a DIN, which is a unique identification number.

File Incorporation Documents:

- Submit the incorporation form along with the required documents, such as ID proofs, address proofs, and the LLP agreement.

Draft and Register the LLP Agreement:

- The LLP agreement outlines the roles, responsibilities, and profit-sharing ratios of the partners. It must be signed and filed with the registrar.

Obtain the Certificate of Incorporation:

- Once approved, you will receive a Certificate of Incorporation, officially registering the LLP.

Compliance Requirements for an LLP

Although LLPs are easier to manage than companies, they must adhere to certain compliance obligations, including:

- Filing annual returns with the Registrar of LLPs.

- Maintaining financial records and filing income tax returns.

- Conducting audits if turnover exceeds prescribed thresholds.

Who Should Choose an LLP?

An LLP is an ideal business structure for:

- Professionals such as lawyers, accountants, and consultants.

- Startups and small to medium-sized businesses seeking limited liability protection.

- Entrepreneurs who value flexibility in management without the complexity of a company structure.

- Businesses that do not require significant external funding

Conclusion

A Limited Liability Partnership is a perfect blend of flexibility and protection, making it an excellent choice for businesses seeking a structured yet adaptable model. It provides limited liability to partners while ensuring operational ease and cost-efficiency. However, its limited fundraising capabilities and mandatory compliance might not suit every business. By carefully drafting an LLP agreement and adhering to regulations, you can establish a robust and sustainable business entity.

Let me know if you’d like detailed guidance on drafting the LLP agreement or navigating compliance requirements!

Crestfin Tipsers Pvt. Ltd. is a private company registered under the Companies Act, 2013.With the facility of a proficient team of professionals, we provide a wide variety of services.

Quick Links

Useful Links

- Privacy Policy

- Terms and Conditions

- Disclaimer

- Support

- FAQ

Contact

Looking for collaboration?

info@cristfintipsers.com

Visit our Office

Plot 2 Mahatma road New Delhi pin code 110058

Monday-Friday: 08am-9pm

+91 9541760533

Tax Advisor & Financial Consulting by Cristin Tipsers

Copyright © 2021. All rights reserved.